The life insurance policy was approved. Mike and Sarah Miller had crossed the biggest item off their financial protection to-do list. As they sat down with the final paperwork, they came to the beneficiary designation section, a step that hinged on understanding the crucial difference between a primary vs contingent beneficiary.

“Okay, for Primary Beneficiary, I’m putting you, Sarah,” Mike said, pen in hand.

“And I’m putting you,” Sarah replied. “Simple enough.”

But the next line on the form gave them pause: Contingent Beneficiary.

“I’m not sure I understand,” Mike admitted. “If you’re the primary, why do we need a contingent? Doesn’t that just complicate things?”

It’s a common and critical question. On the surface, it seems redundant, but a contingent beneficiary is arguably one of the most important safety nets you can put in place. The difference between a primary vs contingent beneficiary is the difference between a secure plan and a potential legal disaster.

Your Guides for Today: The Miller Family

To make things simple, we’re using a fictional family to explore this topic.

- John & Mary (60s): The retired grandparents, focused on preserving their wealth and legacy.

- Mike & Sarah (40s): The parents, navigating their peak earning years, a mortgage, and saving for the future.

- Leo & Emily (Teens/Kids): The next generation, learning the basics of money.

This box is skippable for regulars but invaluable for newcomers.

Defining the Roles: The First in Line vs. The Safety Net

To understand this, it’s best to think about the specific job each beneficiary is hired to do.

The Primary Beneficiary: The Direct Recipient

The primary beneficiary is the person, people, or entity with the first legal right to receive your policy’s death benefit. They are first in line, and the payment is made directly to them.

- Their Function: To be the undisputed, immediate recipient of the funds.

- The Millers’ Choice: Mike names Sarah as his 100% primary beneficiary. As his wife, she is the logical choice to receive the capital needed to manage the household and care for their children.

The Contingent Beneficiary: The Essential Backup

The contingent beneficiary is your backup. They receive the death benefit only if the primary beneficiary cannot.

- Their Function: To act as a crucial fallback, ensuring the policy’s proceeds do not get redirected to your estate and into a court system.

- The Millers’ Choice: They know they can’t name their minor children directly. As detailed in our Guide to Choosing a Beneficiary, this triggers court involvement. Instead, they name “The Miller Family Trust” as their contingent beneficiary, creating a secure legal entity to manage the funds for their children.

A Direct Comparison: Primary vs. Contingent Beneficiary

This table outlines the core differences in their roles and activation triggers.

| Feature | Primary Beneficiary | Contingent Beneficiary |

| Legal Standing | The designated first-in-line recipient of the policy proceeds. | The designated second-in-line recipient; a successor. |

| Activation Trigger | Your passing. The claim process begins immediately. | Only activated if all primary beneficiaries are deceased, ineligible, or legally refuse the benefit. |

| Primary Purpose | To fulfill the main financial goal of the policy (e.g., income replacement). | To prevent the policy proceeds from going into probate court. |

Why a Contingent Beneficiary is a Non-Negotiable Part of Your Plan

The most important question is: what happens if I don’t have one? Leaving the contingent beneficiary line blank creates a massive vulnerability in your financial plan. Here are the scenarios where the contingent beneficiary’s role becomes critical:

- Common Disaster Scenario: If the primary beneficiary dies in the same event as the policyholder, the benefit flows seamlessly to the contingent beneficiary. Without one, it goes to the estate.

- Primary Beneficiary Predeceases: If your primary beneficiary passes away and you forget to update your policy, your contingent beneficiary automatically becomes the primary.

- Beneficiary Disclaims Benefit: In rare cases, a primary beneficiary may refuse the inheritance for their own financial or legal reasons. The benefit then passes to the contingent.

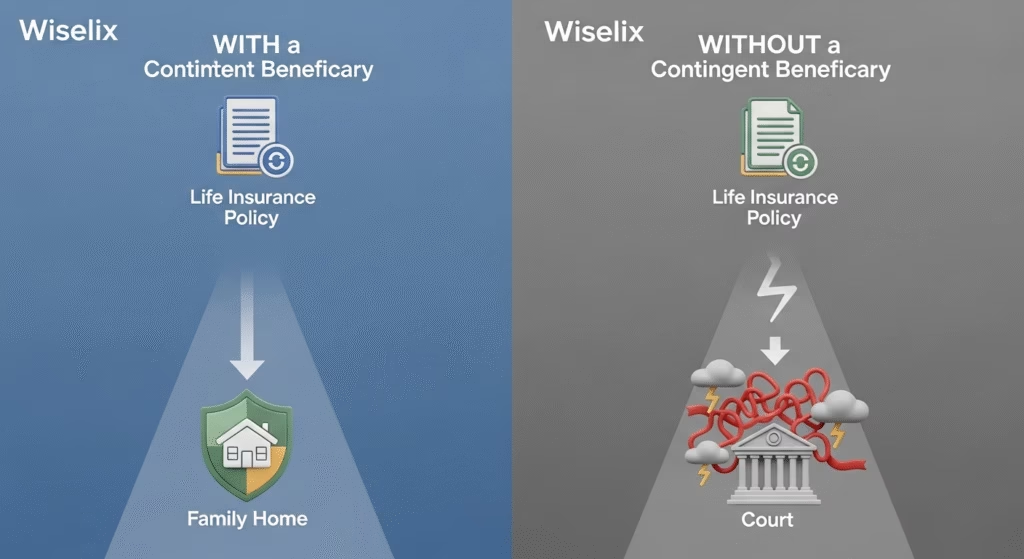

The Worst-Case Scenario: No Contingent Beneficiary

If any of the above happens and you have no contingent beneficiary listed, the insurance company has no choice but to pay the death benefit to your estate. This means the money gets:

- Stuck in Probate Court: A slow, public, and often costly legal process.

- Exposed to Creditors: Lawyers and creditors get first claim to the assets in your estate.

- Delayed for Your Family: It can take many months, or even years, for your heirs to receive any remaining funds.

Naming a contingent beneficiary avoids this entire legal mess, preserving the powerful advantage of life insurance: a swift, private, and according to the IRS, tax-free payout.

Conclusion: A Complete Plan Requires Both Roles

Mike and Sarah filled out both lines on the form with a new level of confidence. They understood they weren’t just naming people; they were building a legally sound succession plan. Their primary beneficiary designation addressed the immediate future. Their contingent beneficiary designation protected their legacy against unforeseen tragedy.

When you designate your beneficiaries, remember that both roles are essential. The primary is your plan. The contingent is the safety net that ensures your plan succeeds, no matter what life throws your way.

Frequently Asked Questions (FAQ)

1. Is a secondary beneficiary the same as a contingent beneficiary?

Yes. The terms “contingent beneficiary” and “secondary beneficiary” are used interchangeably in the industry to refer to the second-in-line recipient.

2. Can I name multiple beneficiaries in each category?

Absolutely. You can have multiple primary and multiple contingent beneficiaries. You simply assign a specific percentage of the proceeds to each one, ensuring the total adds up to 100% in each category.

3. Does a contingent beneficiary have any legal rights to the policy?

No. As long as a primary beneficiary is alive and able to accept the proceeds, a contingent beneficiary has no rights or claim to the policy. Their standing is entirely dependent on the primary beneficiary being unable to inherit.