The letter arrived. Dave, a friend of Mike Miller, opened it feeling hopeful. He’d done everything to prepare for his life insurance medical exam and was hoping for a great “Preferred” rate to protect his family.

Then, his eyes landed on the lab summary. A single line was highlighted: ALT (Liver Enzyme): 75 U/L.

Below it, the final offer hit him like a punch to the gut: Standard.

A wave of panic set in. “Seventy-five? What does that even mean? I feel perfectly healthy! Did I fail the test? Is this the only price I can get?”

Getting surprising lab results can feel final and discouraging. But it’s not the end of the story. In fact, it’s a moment that gives you a new level of control over your health and your finances. This guide will show you exactly what to do after unexpected life insurance lab results.

Your Guides for Today: The Miller Family

To make things simple, we’re using a fictional family and their friends to explore this topic.

- John & Mary (60s): The retired grandparents, focused on preserving their wealth and legacy.

- Mike & Sarah (40s): The parents, navigating their peak earning years and protecting their future.

- Dave (40s): Mike’s coworker, navigating the life insurance application process right now.

It’s Not a “Fail”—It’s a Dashboard Light

That afternoon, a discouraged Dave showed Mike the report. “I don’t get it,” he said. “Because my liver enzymes were a bit high, they gave me a Standard rating. That one little number is going to cost me thousands more over the years.”

Mike, having just finished this exact process, leaned in. “It’s not a test you can fail, Dave. It’s just a snapshot in time.”

He continued, “Think of it like this: an insurance underwriter is a mechanic. Their job is to check your car before a 30-year road trip. A little yellow ‘check engine’ light doesn’t mean the car is broken. It just means the mechanic wants a closer look before handing over the keys.”

This is the most important thing to remember. Your lab results aren’t judging you. They’re just data from one single day.

Understanding the Most Common “Yellow Lights”

So what do these strange acronyms on your lab report even mean? Here’s a simple translation of the most common flags that pop up.

| Lab Marker | What It Actually Measures | A “Yellow Light” Result | Simple Things That Can Cause This |

| Liver Enzymes (like ALT) | Shows how hard your liver is working. | A little over the normal range. | A tough workout, taking Tylenol or other meds, or even a rich, fatty meal the night before. |

| Cholesterol Ratio | Your long-term risk of heart issues. | A ratio over 5.0. | Not fasting correctly before the test or a diet high in processed foods. |

| A1c (Blood Sugar) | Your average blood sugar from the past 3 months. | Between 5.7% – 6.4%. | A diet with a lot of sugar and white bread. It’s often the very first sign you can make healthy changes. |

Dave’s 75 ALT level was a classic “yellow light.” As explained in this helpful guide from the Mayo Clinic, results like these are very common and often not a sign of serious illness. But for an insurance company, it was just enough to be cautious and offer him a Standard (average) rate instead of a Preferred (excellent) rate.

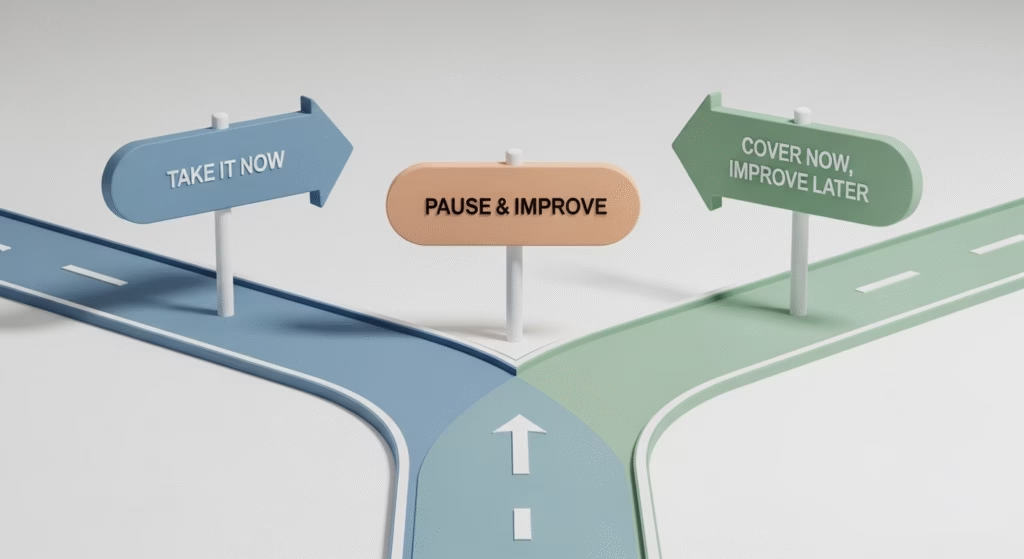

Your Three Choices: What to Do Next After Unexpected Life Insurance Lab Results

When you get an offer that’s not what you hoped for, you have all the power. Here are your three main options, explained in simple terms.

Option 1: Take the Offer Today

You accept the policy at the Standard rate. Your family is protected immediately. This is the best choice if you need coverage in place right now for a new mortgage or business loan. Peace of mind is the priority.

Option 2: Hit ‘Pause’ and Improve Your Results

You tell the insurance company to put your application on hold for 6-12 months. This gives you time to talk to a doctor and make small lifestyle changes. This was Dave’s choice, as he wasn’t in a huge rush and felt confident he could improve his numbers.

Option 3: Get Covered Now, Improve Your Rate Later

You accept the Standard policy so your family is protected right away. Then, after a year or two of improved health, you ask the company for a “reconsideration”—which is basically asking for a do-over on your rate. This is often the best of both worlds: you get immediate protection with the chance to save money down the road.

Dave’s Simple 4-Step Action Plan

Once Dave understood his options, his panic disappeared. He now had a plan.

Step 1: Understand the “Why.” He remembered he’d had a big steak dinner the night before his exam and had taken ibuprofen for a headache. He realized these were likely the simple reasons for the “yellow light.”

Step 2: Talk to His Insurance Agent. He called his agent, who was incredibly reassuring. The agent confirmed that pausing the application for six months was a common and easy process.

Step 3: Get a Professional Opinion (His Doctor). Dave scheduled a check-up. His doctor wasn’t concerned and confirmed the result was likely temporary. He gave Dave a few simple tips, like cutting back on fried foods for a bit.

Step 4: Make a Plan and Ace the Retest. Dave made the small changes. Six months later, he took a new medical exam. His liver enzyme level was back to a perfect 32 U/L. A few weeks later, his new offer arrived: Preferred. He got the excellent rate he wanted, saving his family a significant amount of money on their life insurance policy.

Conclusion: Turning a Surprise into Strength

An unexpected lab result isn’t a final grade. It’s just feedback. It’s a chance to learn something about your health and take control of your financial plan.

By seeing your results as information, not a failure, you turn a moment of worry into an opportunity. You can choose the path that works best for you, ensuring your family gets the protection they deserve at the best possible price.

Frequently Asked Questions (FAQ)

1. If I pause my application, do I have to do the whole medical exam again?

Yes. And that’s a good thing! The goal is to give the insurance company a brand new, healthier snapshot of you so you can earn a better rate. Our guide to the medical exam can help you prepare.

2. I took the Standard policy. Can my price ever go down?

Absolutely. After your policy has been in place for at least a year, you can request a rate review, or “reconsideration.” If you show you’ve made lasting health improvements, the company can lower your monthly premium for the rest of the policy’s term.

3. What if I have a condition like high blood pressure? Will I get unexpected life insurance lab results?

Not at all. Insurance companies are actually looking for proof that a condition is being managed well. A person with well-controlled high blood pressure is often seen as a better risk than someone with borderline numbers who is ignoring it. For more details, see our guide on getting life insurance with high blood pressure.