It’s one of the most important financial tools you may ever own, yet for many, it remains a black box. The world of life insurance is filled with intimidating jargon, conflicting advice, and a cloud of uncertainty that makes many people simply… avoid it.

But what if you could change that? What if understanding life insurance was as simple as following a story?

That’s the journey we’re starting today. We’ll join a typical family, the Millers, as they navigate the entire process—from their first confused questions at the kitchen table to the final peace of mind that comes with a signed policy. This comprehensive guide to life insurance is designed to be the only one you’ll need, translating a complex topic into a clear, actionable plan.

Key Takeaways Box

- What It Is: A legal contract that pays a tax-free sum of money to your loved ones if you pass away, in exchange for your premium payments.

- Primary Goal: To replace your income and eliminate debt, ensuring your family’s financial stability.

- Who Needs It? Anyone with dependents (a spouse, children) or significant co-signed debts.

- Best Type for Most People: Term Life Insurance offers the most protection for the lowest cost.

- How it Works: You transfer the financial risk of your premature death to an insurance company for a fee.

Your Guides for Today: The Miller Family

To make things simple, we’re using a fictional family to explore this topic.

- John & Mary (60s): The retired grandparents, focused on preserving their wealth and legacy.

- Mike & Sarah (40s): The parents, navigating their peak earning years, a mortgage, and saving for the future.

- Leo & Emily (Teens/Kids): The next generation, learning the basics of money.

This box is skippable for regulars but invaluable for newcomers.

Chapter 1: The Core Concept: How Does Life Insurance Work?

The journey for Mike and Sarah Miller started with one fundamental question: “Where does this money even come from?”

“It feels like a lottery ticket in reverse,” Mike admitted. “It just seems too good to be true.”

This is a common feeling. The mechanism behind life insurance is called risk pooling.

Imagine you live in a town with 100,000 households. The town’s statistician knows that, tragically, about 100 people will pass away unexpectedly each year. No one knows who it will be, but the number is predictable.

So, everyone agrees to put $50 a year into a giant community “Safety Fund.”

- 100,000 families x $50/year = $5,000,000 collected annually

When one of the 100 people passes away, the fund gives their family a check for

50,000(‘5M / 100 families`)This is a simplified version of how life insurance works. You and millions of others pay a small, calculated fee (your premium) into a large pool managed by an insurance company. In return, the company provides a legally binding promise—a policy—to pay a large, pre-determined, tax-free sum (the death benefit) to your loved ones (beneficiaries) if you pass away while the contract is active.

You aren’t betting against yourself. You are joining a massive financial safety net.

Chapter 2: The Big “Why”: Identifying Your Need for a Policy

Once the “how” was clear, the “why” became the next topic at the Miller table. Not everyone needs life insurance, and understanding the purpose is key.

The Golden Rule: You need life insurance if your death would cause a financial hardship for someone else.

Here’s how the Millers assessed their own family:

- For Parents with Dependents (Mike & Sarah): Absolutely Essential. They have a mortgage, student debt, and children who rely on Mike’s income for everything from groceries to future college tuition. Their need is at its peak. This is the prime demographic for a strong life insurance policy.

- For Young Adults with No Dependents (A hypothetical young Leo): It Depends. Is Leo single with no debt? Then he probably doesn’t need it. But what if he co-signed a private student loan with his parents? Then a small, cheap policy to cover that specific debt would be a smart, selfless purchase. Life insurance for young adults is often about protecting parents from co-signed liabilities.

- For Retirees (John & Mary): Likely Not. As “empty nesters” with a paid-off house and a healthy pension, they are “self-insured.” Their savings are sufficient to cover their final expenses and leave a legacy. They had a term policy when Mike was a child, but they correctly let it expire.

- For a Stay-at-Home Parent (Sarah’s Role): Yes! A Critical Need. Even though Sarah’s income is smaller, her contribution to the family has immense economic value. If she were to pass away, Mike would have to pay for childcare, house cleaning, and other services that Sarah provides. A stay-at-home parent absolutely needs life insurance.

READ THIS BLOG TO UNDERSTAND IT COMPLETELY .

Chapter 3: Decoding the Policy Types (The Complete Breakdown)

“Okay, we need it,” Sarah said, determined. “Now for the hard part. The market is a maze of different products.” This section of our guide to life insurance will demystify them completely.

3.1 Term Life Insurance: The Simple Choice

This is the workhorse of the life insurance world and the right fit for most families.

- How it works: You buy coverage for a specific period (the “term”), typically 10, 20, or 30 years. You pay a level premium that never changes. If you die during the term, your family gets the payout. If you outlive the term, the policy expires.

- Pros: Incredibly affordable, simple to understand, provides the maximum death benefit for the lowest cost.

- Cons: It’s temporary. It has no cash value or investment component. (This is also a pro, as it keeps it cheap).

- Analogy: It’s like renting an apartment. You have full protection while you live there, but you don’t build any equity.

3.2 Whole Life Insurance: The Bundled Product

This is the most common type of permanent life insurance.

- How it works: The policy is designed to last your entire life and never expire. Premiums are significantly higher and remain level. A portion of your premium pays for the insurance, while another portion is diverted into a savings component called cash value, which grows at a modest, guaranteed rate.

- Pros: Lifelong coverage, builds cash value you can borrow against.

- Cons: Very expensive, low returns on cash value compared to traditional investing, complex.

- Analogy: It’s like buying a house with a very conservative mortgage company. It’s a permanent solution, but the payments are high, and your “equity” grows very slowly.

3.3 Universal & Other Permanent Policies: The Hybrids

These are more complex forms of permanent insurance that offer more flexibility than whole life.

- Universal Life (UL): Allows you to adjust your premium payments and death benefit amount over time. It offers more flexibility but less certainty than whole life.

- Variable Universal Life (VUL): Similar to UL, but it allows you to invest your cash value portion in sub-accounts similar to mutual funds. This introduces market risk and potential for higher returns (or losses).

The Wiselix Verdict: For most people, the smart financial move is to “buy term and invest the difference.” The complexity and high cost of permanent policies often outweigh their benefits. Mike and Sarah firmly chose a 30-year term policy.

Chapter 4: Calculating Your “Magic Number”: How Much Coverage is Enough?

For a more detailed version of this chapter, see our dedicated post on this topic. CLICK HERE

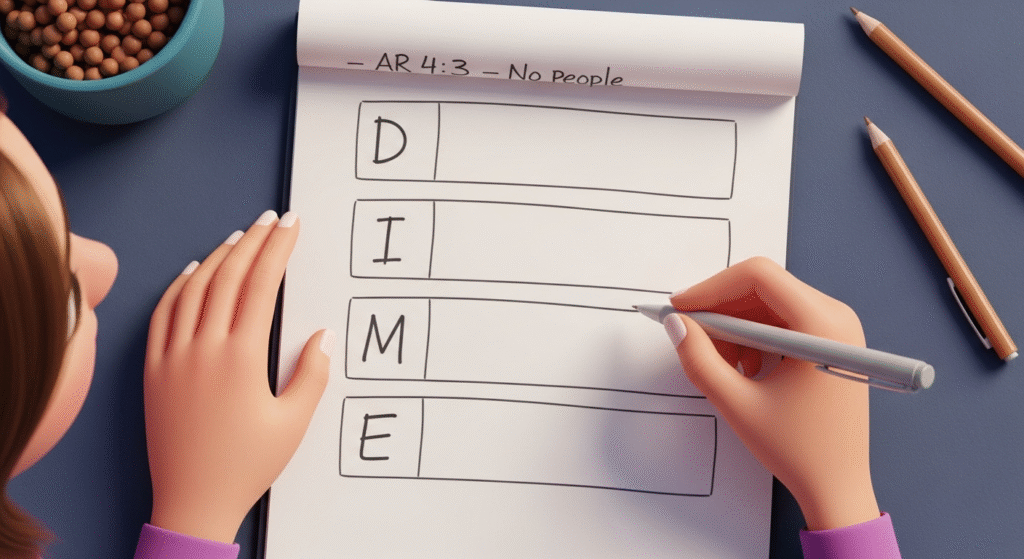

Once the Millers chose Term Life, they had to determine their coverage amount. They rejected the simple “10x income” rule as too generic. Instead, they embraced the DIME Method for a personalized calculation.

- D (Debt): They added all non-mortgage debt plus estimated final expenses.

- I (Income): They calculated 10 years of Mike’s income to support the family.

- M (Mortgage): They added their entire outstanding mortgage balance.

- E (Education): They factored in funds for both kids’ college education.

The Crucial Final Step: They subtracted their existing financial assets (savings, 529 plans, work insurance) from the total DIME number to arrive at their final coverage need: $1.6 Million.

Chapter 5: What Does Life Insurance Actually Cover?

“So if I have that $1.6 million policy,” Mike asked, “what can Sarah actually use it for? Are there rules?”

The beauty of a life insurance death benefit is its flexibility. It’s a tax-free lump sum of cash that can be used for anything the beneficiaries need. There are no restrictions. What life insurance covers is entirely up to the family. Common uses include:

- Immediate Needs: Funeral costs, medical bills, estate taxes.

- Debt Elimination: Paying off the mortgage, car loans, credit cards, and student loans.

- Income Replacement: Providing monthly income for daily living expenses like groceries, utilities, and childcare.

- Future Goals: Funding college education, paying for a wedding, or ensuring a surviving spouse has a secure retirement.

Essentially, it covers life.

Chapter 6: Customizing Your Policy: Understanding Common Life Insurance Riders

“During the quote process,” Sarah noted, “it asked about adding ‘riders.’ What are those?”

Riders are optional add-ons that enhance a basic policy, usually for a small additional cost. Here are the most important ones to understand:

- Accelerated Death Benefit Rider (Included for free with most term policies): This is the most valuable rider. It allows you to access a portion of your own death benefit while you are still alive if you are diagnosed with a qualifying terminal illness.

- Waiver of Premium Rider: If you become totally disabled and are unable to work, this rider will pause your premium payments, but your life insurance coverage remains active. It’s insurance for your insurance.

- Child Rider: A single, inexpensive rider that provides a small death benefit (e.g., $10,000) for all of your children. It’s a simple way to get some coverage for final expenses without buying separate policies for each child.

The Millers decided to add the Waiver of Premium Rider for extra peace of mind.

Chapter 7: The Buying Process Unmasked: From Quote to Coverage

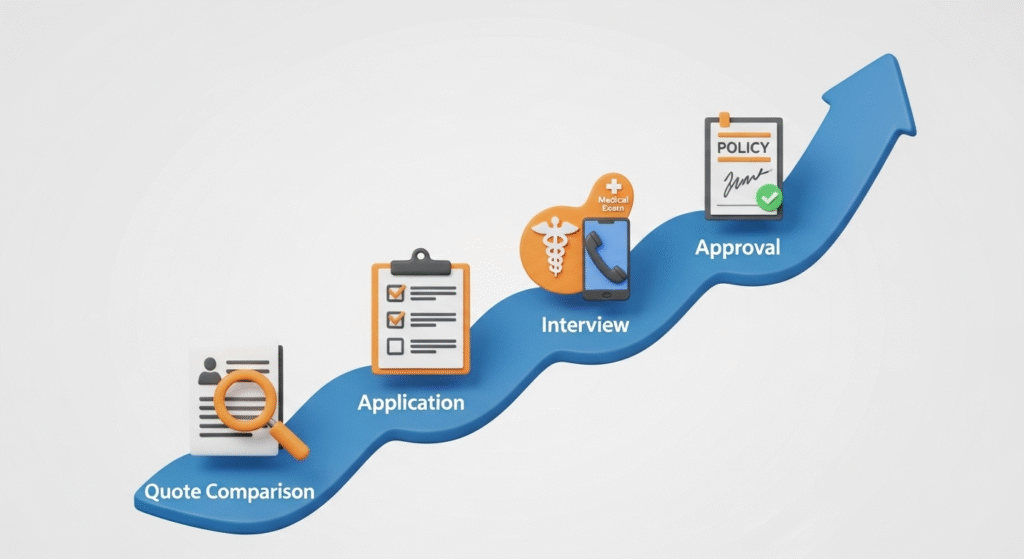

This part often feels like a mystery. How do you go from a number on a notepad to an active policy? This is how to buy life insurance.

- The Quote Comparison: The Millers used an online marketplace to anonymously compare real-time quotes from over a dozen highly-rated insurers.

- The Application: They chose the most competitive A+ rated insurer and completed a detailed online application about their health and lifestyle. Honesty is non-negotiable here.

- The Phone Interview: A brief call with the insurance company to verify the application details.

- The Medical Exam (or Not): For their coverage amount, a free at-home paramedic exam was needed. (Many policies today use “accelerated underwriting” and skip this step based on data).

- The Underwriting Wait: This is the 3-6 week period where the insurer reviews all the data to finalize the rate.

- The Final Offer & Policy Delivery: They received the final offer, which matched their initial quote. They signed the documents electronically and made their first payment. Their family was officially protected.

Chapter 8: Glossary of Life Insurance Basics

- Beneficiary: The person(s) or entity you name to receive the death benefit.

- Premium: The regular payment (monthly or annually) you make to keep the policy active.

- Policyholder: The person who owns the insurance contract.

- Face Amount: The total dollar amount of the death benefit.

- Underwriting: The insurer’s risk-assessment process.

Conclusion: Life Insurance as a Cornerstone of Financial Wellness

From a kitchen table filled with confusion, the Millers emerged with a solid plan and profound peace of mind. They learned that understanding life insurance isn’t about becoming an expert in complex financial instruments. It’s about understanding a promise—a promise that your love and provision for your family can endure, even if you are no longer there.

It’s a foundational piece of any solid financial house. By following this guide, you now have the tools and the confidence to build yours.

Frequently Asked Questions (FAQ)

1. What is the best life insurance company?

There is no single “best” company. The best one for you is the reputable company that offers you the lowest premium for your specific health profile and coverage needs. That’s why comparing quotes is so important.

2. Is the death benefit from life insurance taxable?

In almost all cases in the United States, the death benefit paid to beneficiaries is not subject to federal income tax.

3. What happens if I outlive my term life insurance policy?

If your term ends and you are still living, the policy simply expires. There is no refund of premiums paid. This is the expected outcome—it means you didn’t need it, which is the best-case scenario! You received the peace of mind of being protected during those years.

4. Can I have more than one life insurance policy?

Yes. It’s common to have a smaller policy through your employer and a larger, private term policy that you own and control.