Mike Miller, the family’s 40-year-old main breadwinner, was on the phone with their new insurance agent, a sense of accomplishment washing over him. Their life insurance policies were officially approved. He and his wife, Sarah, had finally secured their family’s financial safety net.

“Excellent news, Mike,” the agent said warmly. “Now for the final step, we just need to decide which riders you’d like to add to your policy.”

Mike’s brow furrowed. “Riders? What are those?”

“Well,” the agent began, “we have the Waiver of Premium Rider, the Accelerated Death Benefit Rider, the Child Term Rider, a conversion rider…”

The confident feeling evaporated, replaced by a wave of confusion. Suddenly, it felt like he was buying a car, and after agreeing on the price, the salesperson started asking if he wanted the undercoating, the premium sound system, and the extended warranty. This happened right after the Life Insurance Underwriting Process was completed, a step that followed his surprisingly simple Life Insurance Medical Exam. Are these riders essential? Are they expensive? Or are they just upsells?

This is where many people get lost. But it is also where you can transform a standard policy into a personalized shield. Today, we’ll provide a comprehensive life insurance riders explained guide, so you can confidently choose the ones that are right for you.

Your Guides for Today: The Miller Family

To make things simple, we’re using a fictional family to explore this topic.

- John & Mary (60s): The retired grandparents, focused on preserving their wealth and legacy.

- Mike & Sarah (40s): The parents, navigating their peak earning years, a mortgage, and saving for the future.

- Leo & Emily (Teens/Kids): The next generation, learning the basics of money.

This box is skippable for regulars but invaluable for newcomers.

What Are Life Insurance Riders? Your Policy’s Optional Features

That evening, Mike, still feeling uncertain, explained his confusion to the family. Grandpa John, the ever-practical 68-year-old retired factory worker, nodded knowingly.

“It’s exactly like buying that car,” he said. “Your main policy—the death benefit that protects your family if you pass away—is the car itself. That core protection is the most important part, as we cover in our Ultimate Guide to Understanding Life Insurance. The riders are the optional features.”

John continued, “They don’t change the car’s main purpose. However, they can make the journey much safer and more adaptable to future road conditions. For this reason, understanding what are insurance riders is a key part of the process.”

This car analogy is the perfect way to understand riders. So, let’s take a tour of the showroom and see what features are on offer.

The Showroom Tour: Common Life Insurance Riders Explained

We’ll group the riders into categories: those that help you while you’re alive, those that protect your policy, and those that protect your family. For each one, we’ll see how the Millers decided if it was worth the cost.

Category 1: Living Benefit Riders (The “Airbags and GPS”)

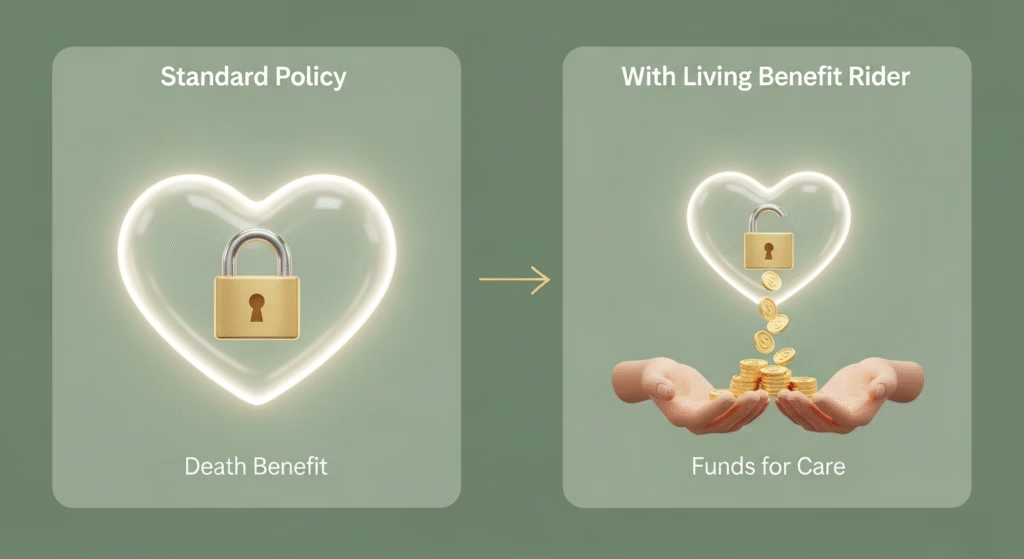

These riders are arguably the most valuable innovations in modern life insurance because they allow your policy to benefit you even if you don’t pass away.

Accelerated Death Benefit (ADB) Rider

- The Car Feature: Think of this as the car’s built-in airbags and SOS system. It’s a standard safety feature that activates in a crisis.

- What it does: The insurance company includes this rider to allow you, the policyholder, to access a large portion (e.g., 50-80%) of your own death benefit while you are still alive if a doctor diagnoses you with a qualifying terminal illness.

- Why it’s powerful: A terminal illness can bring enormous costs. The ADB provides a tax-free cash infusion at the exact moment you need it most, helping you pay for care without bankrupting your family. Therefore, it’s an incredibly valuable benefit.

- The Miller’s Decision: Their agent confirmed the policy included it at no extra cost. This was a “no-brainer.” Verdict: Absolutely worth it.

Long-Term Care (LTC) Rider

- The Car Feature: This is a high-tech navigation and support system for a very long, difficult, and expensive road trip you didn’t plan for.

- What it does: This rider allows you to accelerate a portion of your death benefit to pay for long-term care expenses if you can no longer perform certain “activities of daily living” (like bathing or dressing).

- Why it’s powerful: Standalone LTC insurance can be incredibly expensive. According to government data from www.nia.nih.gov, someone turning 65 today has almost a 70% chance of needing some type of long-term care. An LTC rider is often a more affordable way to get some protection against this financially devastating risk.

- The Miller’s Decision: For Mike and Sarah (in their 40s), the risk felt too far away to justify the immediate cost. However, they made a note to explore this option again in their 50s. Verdict: A powerful but costly option, best considered closer to retirement.

Category 2: Policy Protection Riders (The “Extended Warranty and Roadside Assistance”)

These riders don’t pay out a benefit directly to you; instead, they protect your policy itself from lapsing when life goes wrong.

Waiver of Premium Rider

- The Car Feature: This is the ultimate “payment protection plan” for your policy.

- What it does: If you become totally disabled and are unable to work, the insurance company will pay your premiums for you. As a result, your policy remains in full force.

- The Miller’s Debate: Mike, the main breadwinner, was skeptical. “So, I’m paying extra for insurance on my insurance?” However, Sarah, who manages the family budget, saw it differently. “Your income is what pays for this policy. If that income stops, this rider is the only thing that keeps our entire safety net from collapsing.”

- The Miller’s Decision: They decided the small monthly cost for this powerful protection was a non-negotiable for Mike’s policy. Verdict: A must-have for the primary wage earner.

Term Conversion Rider

- The Car Feature: Think of this as a “trade-in guarantee.” It guarantees you the right to trade your leased Term model for a permanent Whole Life model in the future, regardless of its condition.

- What it does: This provision gives you the right to convert your temporary term life policy into a permanent whole life policy later on, without having to go through another medical exam. As we cover in our complete guide on Term vs. Whole Life Insurance, this flexibility can be critical.

- Why it’s powerful: Suppose Mike develops a health condition in 15 years. With this rider, he can still convert his term policy to a permanent one and keep his coverage, even if he would now be uninsurable on the open market.

- The Miller’s Decision: The agent confirmed this rider was also included for free. They happily accepted it, because it kept their future options open. Verdict: An essential, no-cost feature to look for.

Category 3: Family Protection Riders (The “Child Seats and Extra Rows”)

These types of insurance riders extend coverage to other members of your family under your policy.

Child Term Rider

- The Car Feature: This is like adding built-in, custom car seats for all your kids. It’s an easy, all-in-one solution.

- What it does: For a single flat fee (often just $5-7 a month), this add-on provides a modest death benefit (e.g.,

10,000−10,000−20,000) for each of your children (current and future). - Why parents consider it: Firstly, it covers the immediate, unthinkable costs of a child’s funeral. Secondly, and most importantly, it almost always includes a conversion privilege. This means when your child turns 25, they can convert their rider into their own small permanent policy, regardless of any health issues they may have developed. It guarantees their future insurability.

- The Miller’s Decision: For them, the guaranteed insurability for Leo and Emily was the key selling point. It felt like a gift for their kids’ future. Verdict: A valuable and affordable ‘nice-to-have’ for parents.

The Millers’ Final Selections: A Custom-Fit Plan

After discussing each option, Mike and Sarah made their final choices. They didn’t add every rider available; instead, they selected the ones that solved specific problems relevant to their current stage of life.

Here is a summary of their decisions:

| Rider Selected | Core Function (The “Why”) | The Millers’ Verdict |

| Accelerated Death Benefit Rider | Provides access to their own death benefit if diagnosed with a terminal illness, helping to cover critical end-of-life care costs without draining savings. | ✅ Yes (Included at no extra cost) |

| Waiver of Premium Rider | Acts as insurance for the insurance. If Mike, the main breadwinner, becomes totally disabled, the company pays the premiums, keeping the policy from lapsing when they need it most. | ✅ Yes (For Mike’s policy) |

| Child Term Rider | Offers a small, affordable death benefit for both of their children. Most importantly, it guarantees Leo and Emily the right to get their own coverage as adults, regardless of future health. | ✅ Yes |

| Term Conversion Rider | Guarantees the right to convert their term policy to a permanent one in the future without a new medical exam. This keeps their options open. | ✅ Yes (Included at no extra cost) |

Their choices reflect a key lesson: an effective life insurance plan is more than just a large death benefit. A policy thoughtfully customized with the right riders works hand-in-hand with a proper beneficiary designation to create a comprehensive and resilient financial safety net.

Conclusion: Turning a Standard Policy into a Custom Plan

In the end, Mike understood that his initial confusion was misplaced. Riders aren’t just upsells; they are precision tools. By evaluating each one based on the specific “road hazards” their family might face, they were able to build a policy that was more than just a death benefit—it was a comprehensive suit of armor for their future.

Don’t be intimidated by the options. Approach the topic of life insurance riders explained as a custom design process. Start with the standard model, then ask for each rider, “What problem does this solve, and is that a problem my family needs solved?” By doing so, you’ll drive away with a policy that is perfectly custom-built for you.

Frequently Asked Questions (FAQ)

1. Are life insurance riders worth the extra cost?

It depends entirely on the rider and your personal situation. Some riders, like the Accelerated Death Benefit, are often free and always valuable. For paid riders like the Waiver of Premium, you have to weigh the cost against the value of the protection. If the risk it covers would devastate your family, the small cost is likely worth it.

2. Can I add a rider to my policy later on?

Generally, no. Most riders must be selected when you first apply for the policy. This is why it is so important to understand your options from the start and have a clear guide with life insurance riders explained before you buy.

3. What is a “Payor Benefit Rider”?

This is a rider typically added to a life insurance policy owned by an adult but insuring a child. It states that if the payor (the adult) dies or becomes disabled, the insurance company will waive the premiums on the child’s policy until they reach a certain age, like 21 or 25, ensuring their coverage continues.