A week after his life insurance medical exam, a thick envelope arrived for Mike Miller, the family’s 40-year-old main breadwinner. Inside were pages of lab results filled with a language he didn’t understand: HDL, A1C, triglycerides, creatinine.

He spread the papers across the kitchen table, his initial confidence replaced by a fog of confusion.

“Sarah, come look at this,” he called to his wife, who masterfully manages their family budget. “It feels like I got graded on a test, but I have no idea how to read the score.”

It’s a familiar feeling for many. You take a proactive step for your health and finances, only to receive a report that feels opaque and intimidating. The good news is, once the jargon is translated, the mystery disappears. This guide will provide that simple translation, so you know exactly what insurers are checking, why it matters, and how to prepare for the best possible results.

Your Guides for Today: The Miller Family

To make things simple, we’re using a fictional family to explore this topic.

- John & Mary (60s): The retired grandparents, focused on preserving their wealth and legacy.

- Mike & Sarah (40s): The parents, navigating their peak earning years, a mortgage, and saving for the future.

- Leo & Emily (Teens/Kids): The next generation, learning the basics of money.

Think of It Like a Dashboard, Not a Report Card

John, the wise, 68-year-old retired grandfather, saw their puzzled expressions and offered a powerful analogy:

“Don’t think of it as a pass or fail test,” he said, pointing to the numbers. “It’s like the dashboard in your car. The gauges for oil pressure, engine temperature, and fuel aren’t there to scare you. They just give the mechanic—in this case, the underwriter—a clear picture of how the engine is running.”

That’s precisely how this blood test works. Each marker is just one data point, and together they help an insurer understand your overall health to offer you a fair price. This is a key part of the life insurance underwriting process.

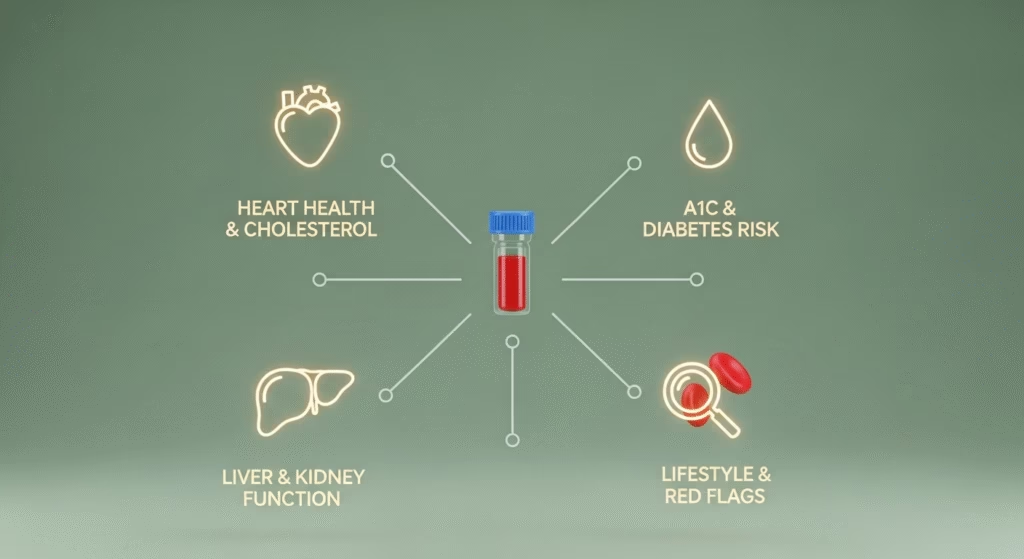

What Does a Life Insurance Blood Test Show?

When you provide a blood sample, the lab screens it for four main categories of information. Let’s break them down.

1. Cardiovascular Health (Your “Engine & Oil Check”)

These markers tell insurers about your heart health and long-term risk of stroke or heart attack, a primary concern for longevity.

| Marker | In Plain English | Why Insurers Care | “Sweet Spot” (Ideal Range) |

| HDL Cholesterol | The “good” cholesterol that cleans arteries. | Higher is better. A high HDL is a strong positive sign. | > 40 mg/dL |

| LDL Cholesterol | The “bad” cholesterol that can clog arteries. | High LDL is a primary risk factor for heart disease. | < 100 mg/dL |

| Cholesterol Ratio | Your Total Cholesterol divided by your HDL number. | This is a key risk indicator. A low ratio is a sign of excellent heart health. | < 5.0 (ideally < 3.5) |

| Triglycerides | A type of fat in your blood used for energy. | Extremely high levels increase the risk of heart disease and pancreatitis. | < 150 mg/dL |

| For a deeper dive into these numbers, authoritative sources like the Mayo Clinic offer excellent, detailed guides. |

2. Diabetes Risk (Your “Fuel Gauge”)

Uncontrolled blood sugar is a major health risk, so insurers rely heavily on these two numbers.

| Marker | In Plain English | Why Insurers Care | “Sweet Spot” (Ideal Range) |

| Glucose | Your blood sugar level at the moment of the test (fasting). | Shows your immediate sugar control. | < 100 mg/dL (fasting) |

| Hemoglobin A1C | Your average blood sugar over the past 2-3 months. | This is the gold-standard test for long-term diabetes risk. | < 5.7% |

Alex’s Note: Of all the markers, insurers pay closest attention to the life insurance A1C levels. Why? Because while a single healthy meal can temporarily lower your glucose, the A1C gives a long-term average that cannot be easily manipulated. It’s the most honest picture of your diabetes risk.

3. Liver & Kidney Function (Your “Filter System”)

Your body’s natural filters—the liver and kidneys—play a massive role in your long-term health.

| Marker | In Plain English | Why Insurers Care | “Sweet Spot” (Ideal Range) |

| Liver Enzymes (ALT, AST, GGT) | Proteins that signal how healthy your liver is. | High levels can suggest inflammation from conditions like fatty liver disease, hepatitis, or heavy alcohol use. | Within lab’s stated normal range |

| Kidney Markers (Creatinine, BUN) | Waste products your kidneys should be efficiently filtering out. | Elevated levels can be an early indicator of kidney issues or chronic kidney disease. | Within lab’s stated normal range |

4. Lifestyle & Other Red Flags

Insurers also screen for a few other things:

- HIV & Hepatitis (standard viral screenings).

- Complete Blood Count (CBC), which can indicate underlying issues like anemia or certain blood disorders.

- PSA (Prostate-Specific Antigen) for male applicants, typically over the age of 50.

How to Prepare: Your 48-Hour Tune-Up Checklist

You can’t overhaul your health in two days, but as Grandpa John advised, “You can make sure the car is tuned up for the big inspection.” This simple prep plan can make a real difference.

- ✅ Hydrate, Hydrate, Hydrate: Drink plenty of water. It helps improve kidney and liver function readings and makes the blood draw much easier.

- ✅ Eat Clean the Day Before: Skip greasy, salty, or very sugary foods. A simple meal of lean protein and vegetables is your best bet.

- ✅ Fast for 8–12 Hours: This is non-negotiable for accurate glucose and cholesterol results. For a morning exam, this just means only water after dinner.

- ✅ Avoid Vices & Intense Exercise: For at least 24 hours, steer clear of alcohol, nicotine/vaping, and very strenuous workouts, as they can all temporarily skew your numbers.

Conclusion: Confidence Through Clarity

Once Sarah, the detail-oriented mother, organized the results into their simple guide, Mike’s stress melted away. What looked like intimidating jargon was actually just a clear snapshot of his overall health—and a good one, at that.

A life insurance blood test isn’t designed to trip you up; it’s a tool insurers use to set a fair price based on your personal health data. If you understand what they’re looking for and follow a few simple prep steps, you can walk into your exam with confidence.

For a complete overview of the entire exam process, not just the blood test, be sure to read our Ultimate Guide to the Life Insurance Medical Exam.

Frequently Asked Questions

1. What happens if my lab results aren’t perfect?

Almost nobody has “perfect” results. Underwriters look at the whole picture. For common, well-managed conditions like high cholesterol or blood pressure, you can often still qualify for excellent rates.

2. What A1C level is acceptable for life insurance?

Ideally, insurers want to see an A1C level below 5.7%. A result between 5.7% and 6.4% indicates pre-diabetes and will likely result in a higher premium. An A1C of 6.5% or higher is considered diabetic, but applicants with well-managed diabetes can still qualify for coverage.

3. Do life insurance blood tests screen for marijuana (THC)?

Yes. Even in states where it is legal, frequent THC use will often result in being classified at “smoker rates,” which can be two to three times more expensive. It is crucial to be upfront about your usage on the application.