Hello, and welcome. My name is Alex.

Let’s be honest: Does the word “finance” make your shoulders tense up? Do terms like “insurance,” “investing,” and “estate planning” feel like a language from another planet?

If you’ve ever stared at a 401(k) form, a life insurance quote, or your own bank account and felt a wave of confusion or anxiety, I want you to know two things:

- You are not alone.

- You have come to the right place.

Welcome to Wiselix.

I created this blog for one simple reason: to be the guide I wish I’d had. Think of Wiselix as a “wise elixir” for financial confusion—a place where we cure complexity with clarity and storytelling. We’re going to ditch the dense jargon and replace it with real-life scenarios, practical examples, and a bit of a story.

To do that, we’re not going to just talk about abstract concepts. We’re going to follow the journey of a family everyone can relate to.

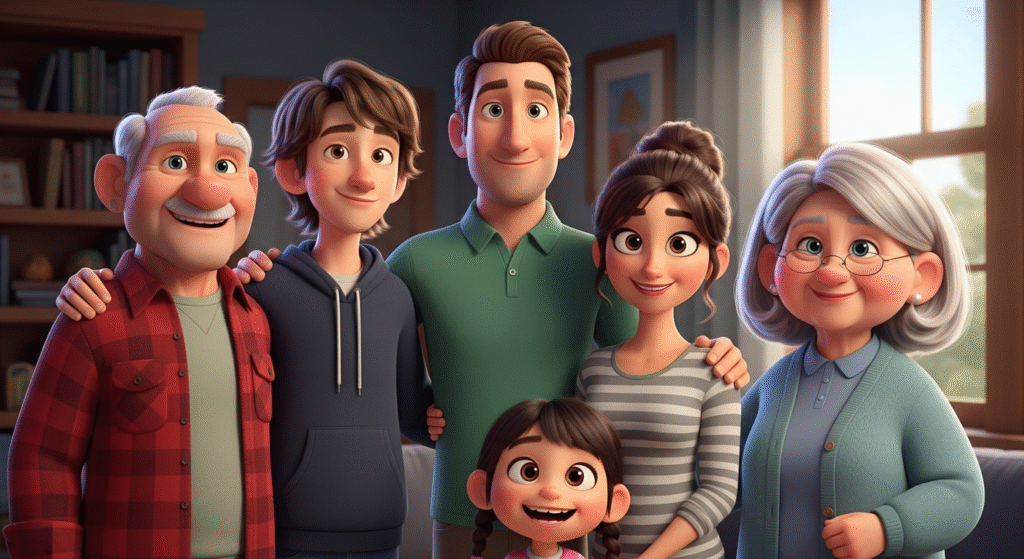

Meet Your Guides: The Miller Family

The Millers are just like us. They’re a multi-generational family navigating the ups, downs, and everyday questions of money. In every article, we’ll join them as they tackle a new financial challenge, and through their story, we’ll learn together.

The Grandparents: John and Mary (60s)

John is a retired factory worker who spent his life providing for his family. He’s wise, practical, and a little old-school. His main focus now is making his pension last and understanding his healthcare options. Mary, a retired teacher, is the heart of the family. She’s thoughtful and detail-oriented, always thinking about the future, her grandchildren, and how to leave a meaningful legacy. Through them, we’ll explore topics like retirement, Social Security, and estate planning.

The Parents: Mike and Sarah (40s)

Mike is a software engineer in his peak earning years, and he feels the pressure that comes with it. He’s ambitious but often feels overwhelmed by major decisions. Sarah, a freelance graphic designer, is the brilliant manager of the household budget. She’s focused on making every dollar count, saving for big goals like college, and making sure the family is protected, no matter what. They’ll be our guides for mortgages, life insurance, investing, and raising financially-aware kids.

The Kids: Leo and Emily

Leo is 16 and just got his first part-time job. He’s suddenly faced with things like taxes, saving for a car, and figuring out what to do with his first real paycheck. His younger sister, 10-year-old Emily, is just starting her financial journey with an allowance and a piggy bank, learning the simple but powerful value of a dollar. Their experiences will help us explain the building blocks of personal finance in the clearest way possible.

How This Blog Works

Our goal here is consistency and clarity. Every post on Wiselix will follow a simple pattern:

- A Relatable Story: We’ll start with a scene from the Millers’ life—a conversation, a problem, a decision they need to make.

- A Simple Breakdown: We’ll pause the story to explain the financial topic at hand in the simplest terms possible. No jargon, just clear, practical definitions.

- An Actionable Plan: We’ll finish with a clear, step-by-step checklist so you can apply the lesson from the Millers’ journey to your own life.

This isn’t about getting rich quick or complicated trading strategies. It’s about building a foundation of knowledge, one story at a time, so you can make confident decisions for yourself and your loved ones.

What’s Next?

In the coming weeks and months, we’ll follow the Millers as they:

- Figure out if they have the right kind of life insurance.

- Try to create their first real family budget that actually works.

- Explore how to start investing without feeling terrified.

- Plan for retirement and college savings at the same time.

It’s going to be a journey, and I’m so glad you’re here to join us. The best way to follow along is to subscribe to our newsletter. You’ll get our latest stories and simple financial wisdom delivered straight to your inbox.

Welcome to the family. Let’s get started.

Frequently Asked Questions (FAQ)

1. Why use a fictional family?

We believe storytelling is the most powerful teaching tool. By following the Millers, complex and intimidating topics become relatable and easier to understand. You’ll see how financial products apply to real life, not just in theory.

2. Do I need to read the posts in order?

Not at all! Every post is designed to stand on its own. We’ll make sure to provide all the context you need in each article, so feel free to jump in on whatever topic interests you most.

3. Who is this blog for?

This blog is for anyone who has ever felt that personal finance is “too complicated.” If you’re a young adult starting out, a parent juggling a dozen financial goals, or someone nearing retirement, the stories of the Millers will have something for you.

This is wonderful! Looking forward to more of this 🙂